In the world of digital finance, cryptocurrency has emerged as a revolutionary asset class, and with it, the need for secure storage solutions has grown exponentially. This is where crypto wallets come into play. A Ledger hardware wallet wallet is a software program or a physical device that stores your public and private keys, enabling you to send, receive, and manage your cryptocurrency securely.

What is a Crypto Wallet?

At its core, a crypto wallet is much like a physical wallet, but for digital currencies. However, unlike a traditional wallet, it doesn’t actually “store” your cryptocurrencies. Instead, it stores the keys (public and private) that give you access to your cryptocurrency on the blockchain.

- Public Key: This is like your bank account number. It’s the address where people can send you cryptocurrency.

- Private Key: This is your secret code, like the PIN to your bank account. You must keep it secure because whoever has access to your private key can access and control the funds in the wallet.

Types of Crypto Wallets

There are several types of crypto wallets, each offering different levels of convenience and security. These can be broadly categorized into:

- Hot Wallets (Software Wallets):

- Hot wallets are software-based wallets that are connected to the internet. They offer ease of access and are ideal for frequent transactions.

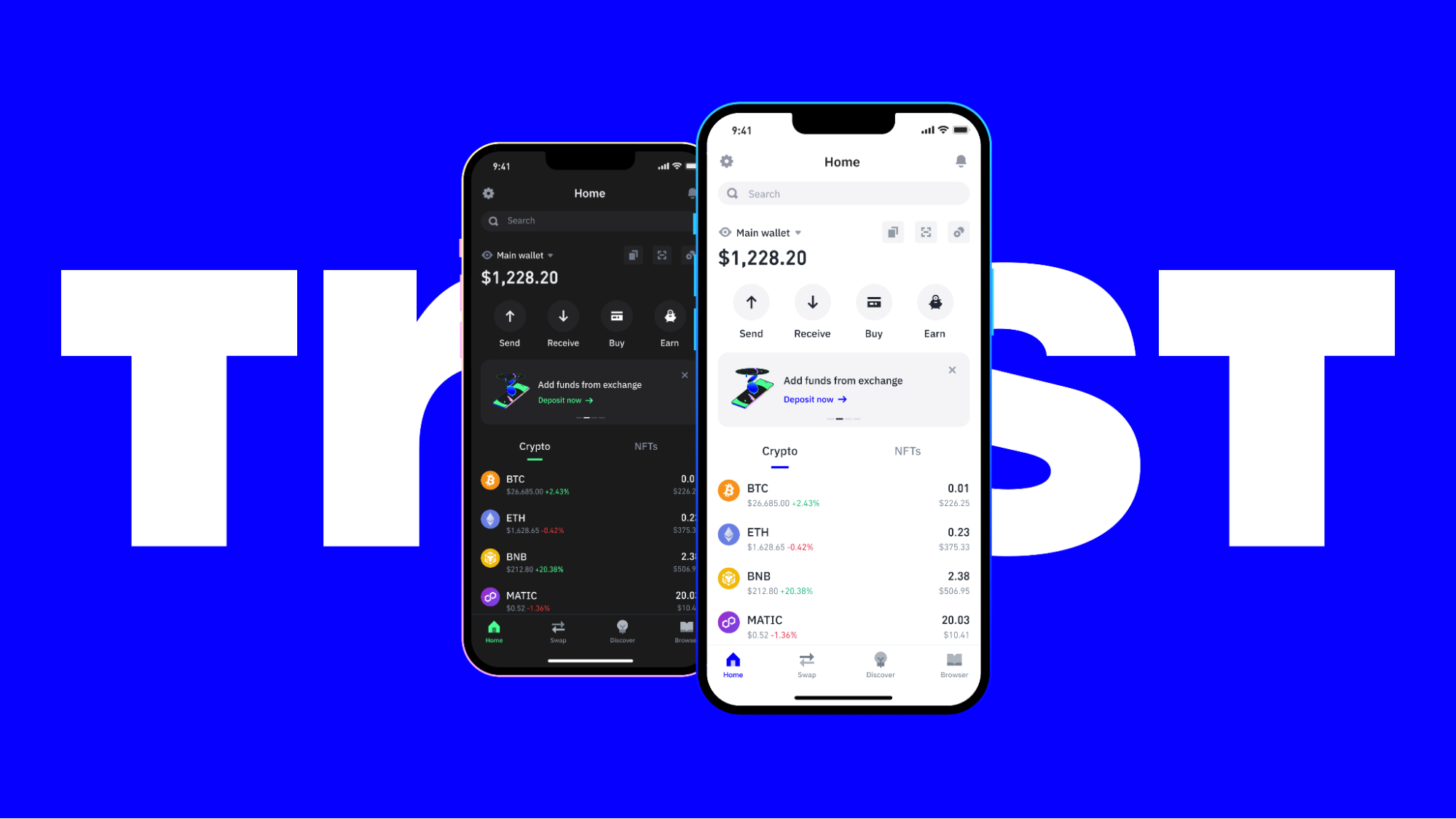

- Examples: MetaMask, Exodus, Trust Wallet, and Coinbase Wallet.

- Pros: User-friendly, quick access to funds, convenient for daily use.

- Cons: Being connected to the internet makes them more vulnerable to hacking attempts.

- Cold Wallets (Hardware Wallets):

- Cold wallets are physical devices that store your private keys offline, making them far more secure against online threats. They are often used for long-term storage of cryptocurrencies.

- Examples: Ledger Nano S, Trezor, KeepKey.

- Pros: Extremely secure since they are not connected to the internet, perfect for long-term storage.

- Cons: Less convenient for quick transactions, physical device needed.

- Paper Wallets:

- A paper wallet is a physical printout of your public and private keys. It’s one of the most secure methods if stored correctly but can be prone to damage or loss.

- Pros: Completely offline, no risk of hacking.

- Cons: Risk of losing the physical paper, can be damaged or destroyed.

- Web Wallets:

- Web wallets are online-based wallets that can be accessed through a browser. They are similar to hot wallets but usually hosted by third-party services.

- Examples: Blockchain Wallet, Blockchain.com.

- Pros: Accessible from any device with internet access, easy to use.

- Cons: Relies on a third party, prone to hacks.

How Do Crypto Wallets Work?

Crypto wallets are powered by cryptographic protocols and blockchain technology. When you create a wallet, you generate a pair of keys: the public key and the private key. The public key is shared with others to receive cryptocurrency, while the private key is kept secret and used to sign transactions, proving that you own the funds being sent.

Whenever you initiate a transaction, the wallet uses your private key to sign it, and the transaction is broadcast to the blockchain network, which then validates and records it. Without the private key, you cannot make transactions, ensuring the security of your funds.

Importance of Security

The security of a crypto wallet is paramount. If someone gains access to your private key, they can access and transfer your funds without your consent. Thus, protecting your private key is essential. To enhance security, many wallets offer additional features, including:

- Two-Factor Authentication (2FA): This adds an extra layer of protection by requiring a second form of authentication (like an SMS code or authentication app).

- Backup Recovery Phrases: Most wallets provide a recovery phrase (usually 12-24 words) that can be used to recover your wallet if your device is lost or damaged.

Best Practices for Securing Your Crypto Wallet

- Use Strong Passwords: Always choose strong, unique passwords for your wallet and accounts.

- Enable Two-Factor Authentication (2FA): Make sure to enable 2FA wherever possible to add an extra layer of security.

- Store Backups Securely: Keep your recovery phrase in a safe place, separate from your wallet.

- Use Hardware Wallets for Long-Term Storage: For long-term holdings, a hardware wallet is the safest option.

- Regularly Update Wallet Software: Ensure your wallet software is up to date with the latest security patches.

Choosing the Right Crypto Wallet

The right wallet for you depends on your specific needs. If you’re an active trader, a hot wallet may be ideal for its accessibility. However, if you’re holding a large amount of cryptocurrency for the long term, a cold wallet offers better security. Always research your options and choose a wallet that fits your level of activity and security preferences.